Due Diligence Focus

We want to ensure that organisations applying to us have the best possible chance of success. To help with this, we’ve outlined some of the most common reasons applications do not meet our eligibility criteria after applying in 2025.

At the assessment stage of the application, we assess the application, governing document, annual accounts, and review an organisation’s online presence.

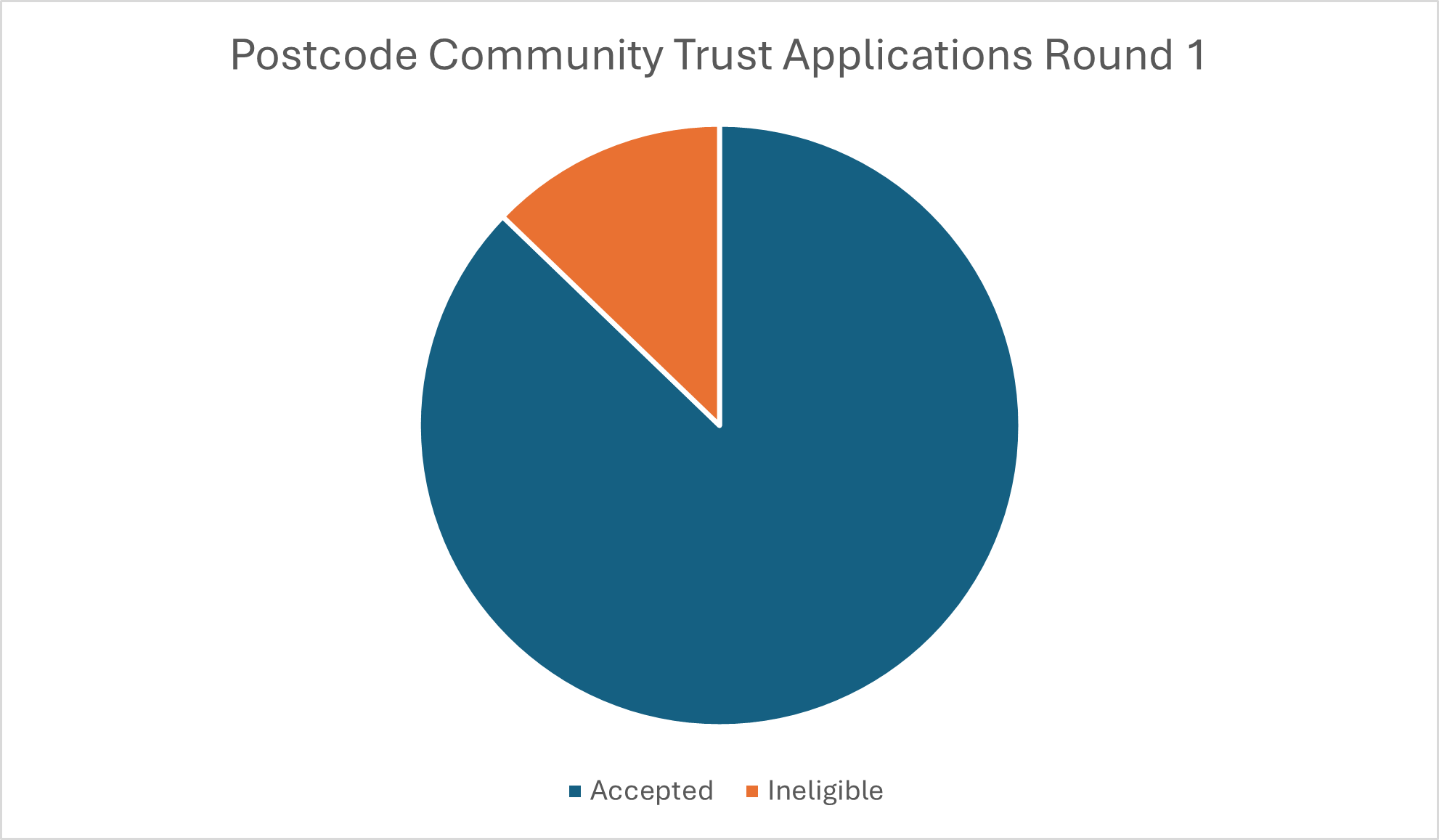

In Round 1 for Postcode Community Trust, 16 out of the 125 applications were deemed ineligible at the assessment stage. Please review the following points before applying to make sure your organisation avoids these common pitfalls.

Common Eligibility Fails

Income and Expenditure Breakdown not Included in Annual Accounts

We require a breakdown of your income and expenditure within your most recent annual accounts submitted with the application.

This is a requirement from the charity regulator for a registered charity. You can find out what is required by the Charity Commission in an organisation's annual accounts here.

Although a company is not required to file a profit and loss account to Companies House if it has been prepared in accordance with the provisions for micro-entities or small companies, it is still necessary for this account to be prepared. We require the profit and loss sheet to be submitted along with the annual accounts so that we can confirm the organisation’s income and expenditure. You can find further information on account requirements here.

If you are a CIC and have provided filleted accounts that do not include a profit and loss sheet, you must also provide an internal profit and loss statement that aligns with the Companies Act 2025 Profit and Loss Accounts format. This must also be signed by a Director.

Independent Examiner’s Report Not Included

If your organisation is required to have its accounts independently examined or audited, the examiner’s report must be submitted alongside your financial statements. Applications missing this report will not meet our eligibility criteria.

Here are the requirements from the Charity Commission:

Charities with an annual income over £25,000 must arrange for an independent examination of their accounts, unless their governing document or a funder requires an audit.

For charities with income over £250,000, the examiner must be a member of a prescribed professional body, such as the Institute of Chartered Accountants in England & Wales (ICAEW). For charities with an income under £250,000, the examiner should have sufficient financial awareness and relevant experience.

Charities with an annual income over £1 million or gross assets over £3.26 million must have their accounts audited.

You can find further information on examiners/audit requirements here.

Income on Application Does Not Match Income in Accounts

We often see discrepancies between the income reported on the application form and the figures shown in the submitted accounts. Please double-check that the income figures you provide are accurate and align with the income on your submitted documents.

An organisation can only apply for 3/4 of the previous year's income that is stated on the most recent set of annual accounts. Please double-check that the income figures you provide are accurate and align with the income on your submitted documents.

Trustees/Directors numbers

We require at least three Trustees to be in place for a registered charity or an eligible registered company.

Our internal requirement is that no more than 50% of an organisation’s trustees/directors are related. If more than half of your trustees are related by blood or marriage, your organisation’s application will be made ineligible.

The organisation's Trustee/Director/Committee members must align with the minimum/maximum stated in the organisation's governing document.

Incorrect Governing Document Provided

We need the most current and correct version of your governing document to be submitted with the application (e.g., constitution, articles of association, or trust deed).

Charities must provide their full constitution; it cannot be a screenshot of their Charity Commission page.

Community Interest Companies must submit their articles of association; this must include the organisation's objects. If the articles of association do not include the organisation’s objects, you must submit the articles of association alongside the CIC 36 form.

The Organisation is part of a National Charity network, and the National Organisation is Already Funded by Players of People’s Postcode Lottery

If your organisation is part of a national charity network and the national branch receives funding from any of the Trusts funded by players of People’s Postcode Lottery, you will not be eligible to apply independently.

You can find a list of organisations that are funded by players of People’s Postcode Lottery here.

Late Filings to the regulator

One common reason applications fail to meet our due diligence requirements is that their submissions to regulators are overdue or late. Our requirements regarding late submissions are as follows:

- If your annual accounts are overdue with your regulator when the application is being assessed, the application will be made ineligible.

- If your latest set of annual accounts is over 60 days late, your application will be considered ineligible.

- You will not be eligible for funding if you have had regular, substantially late filings over the last four years.